-

Phone:

+2348033056352 -

Email:

Info@ajohybrid.com -

Location:

D WING, CORPORATE BLOCK, NATIONAL POPULATION COMMISSION COMPLEX, OPP RITA LORI HOTELS. NO 12-14 BABS ANIMASHAUN STREET, SURULERE, LAGOS

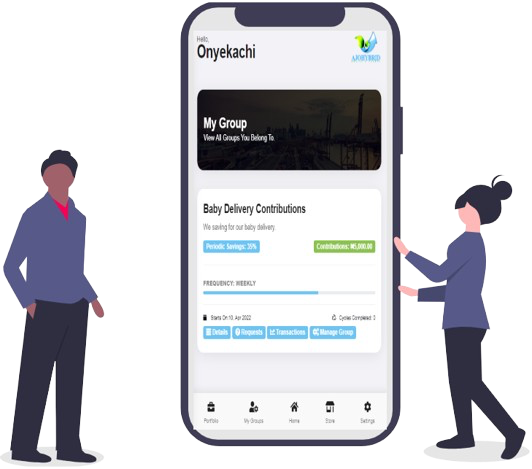

All in one Cooperative, Groups and Association Management

All in one Cooperative, Groups and Association Management

Featured Services

Featured Services